Specialty Heating & Cooling LLC has received a lot of questions from our customers regarding the Inflation Reduction Act of 2022. There is a lot to consider so we wanted you to know that we are here as a resource for you. We are not tax advisors or consultants but we can provide you with the information publicly available. We also encourage you to reach out to a tax professional for tax advice.

WHAT IS THE INFLATION REDUCTION ACT OF 2022?

The United States Government passed the Inflation Reduction Act of 2022, legislation covering a wide range of initiatives. One area related to the HVAC industry includes incentives for the installation of high efficiency home and cooling products.

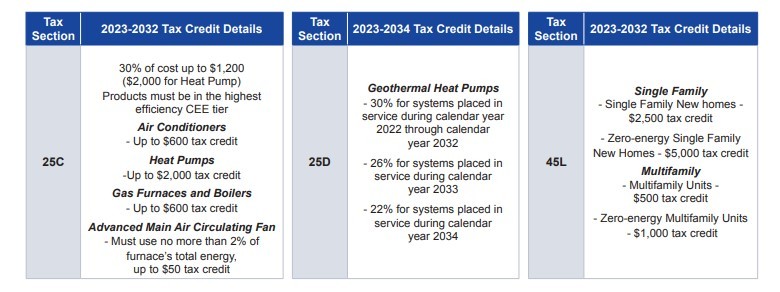

The Inflation Reduction Act of 2022 is 2-pronged – there are federal tax credits and state rebates. For homeowners, the Inflation Reduction Act extends and expands the 25C and 25D tax credits and the 45L for home builders. Check out the IRA FAQ Sheet.

RESOURCES & HELPFUL LINKS:

Below are the available resources to help with your decision to install high efficiency heating and cooling systems in your home. The information and resources you find on this page are from trusted sources including Carrier, the White House, and Energy Star.

White House State Fact Sheet:

The White House released state fact sheets to help guide each state through their respective changes. Read up on the specific details about how the Inflation Reduction Act of 2022 affects the state of Oregon.

Energy Star:

The Department of Energy anticipates sending guidance for the states to start developing their rebate programs in the spring of 2023 at the earliest. State programs may not be available until late 2023 or into 2024. Visit the Oregon Department of Energy for more details and information as it becomes available.

Carrier:

Specialty Heating & Cooling LLC is a Carrier Factory Authorized Dealer. Please visit the homeowners resource page to learn more about which Carrier high efficiency products qualify for the Inflation Reduction Act of 2022. There is also a detailed FAQ Guide.

Aeroseal Duct Sealing

See Aeroseal Tax Credit Packet

When Specialty Heating & Cooling performs Aeroseal duct sealing on your home, you can qualify for 30%, up to $1200 in tax credit.